TAX ADMINISTRATION SINT MAARTEN

On this page you will find information about the Tax Department structure, along with the tasks of the Tax Administration and how revenues from taxes are used.

The Sint Maarten Tax Administration

is an executing agency within the Ministry of Finance of the Government of Sint Maarten.

In a general sense, the Tax Administration is responsible for levying and collecting taxes. This means that on one hand, we ensure that all taxes arising from the law are levied and, on the other hand, that they are paid.

The mission/vision is:

‘We want to levy and collect taxes efficiently by/and maximizing compliance in a fair and transparent manner, enhance the tax data base & providing excellent customer service changing into a more modernized tax administration.’

The Tax Administration consists of the three departments and a section which supports these departments.

The three departments are:

Department description

The Inspectorate of Taxes is tasked with enforcing tax laws with efficiency and integrity. The Inspector of Taxes is formally charged with the implementation of various national regulations, national decree containing general measures, ministerial regulation with general effect, directives, treaties and BRNC, which relate to taxes, employee insurance and national insurance. From these regulations arise the various duties and responsibilities of the Inspectorate of Taxes, as well as the obligations for taxpayers.

The Inspectorate of Taxes is charged with the implementation of the following tax legislations:- Income Tax

- Wage tax and premiums AOV/AWW, AVBZ

- Profit tax

- Turnover tax

- Transfer tax

- Registration Ordinance 1908

Provides and promotes the levying of corrective assessments, audit and investigation of taxes and employee and national insurance premiums.

Encourages compliance, which means that taxpayers and third-party information providers comply with the regulations as much as possible on their own accord.

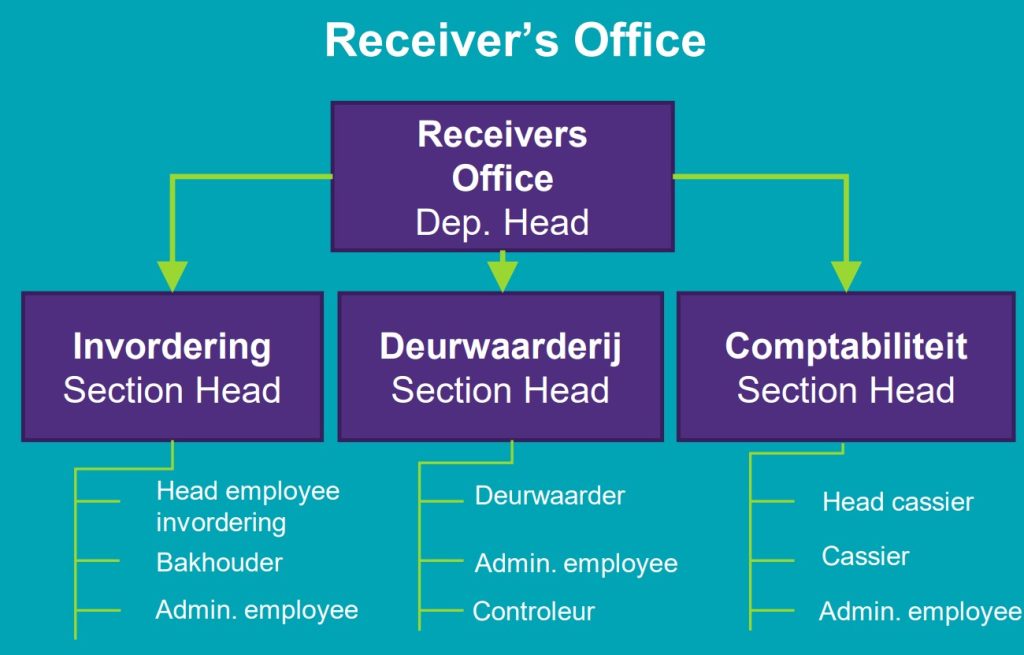

The Receiver's Office is charged with the collection of taxes levied by the Tax Inspectorate as well as other fees and levies billed by the Department of Financial administration.

The main task of the Receiver's Office is:- Collection of taxes and premiums which are paid by declaration or assessed by the Tax Inspectorate.

- Collection of motor vehicle taxes;

- Collection of government fees such as business and directors’ licenses, long lease cannon;

- Collection of stamp duty and excise taxes;

- Making various payments to the taxpayer, such as tax refunds.

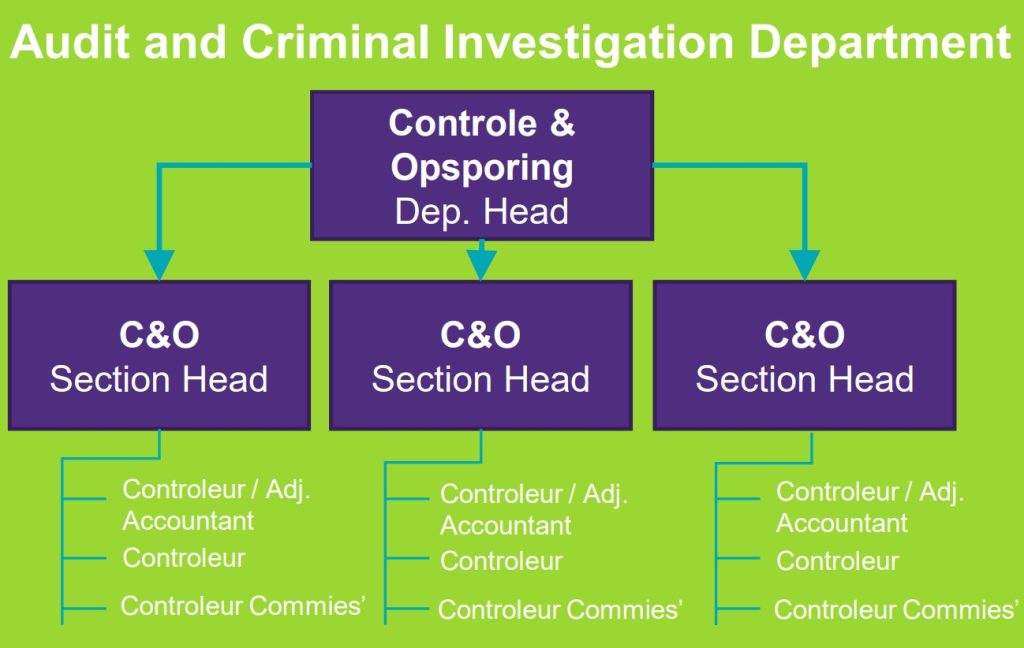

The Audit and Criminal Investigations department ensures the improvement of tax compliance of all companies on Sint Maarten.

The main tasks are:- Conducting tax and premium tax audits.

- Performing a wide variety of activities that promote compliance.

Project Modernization

In 2022, the Tax Administration started a reform process to transform into a more modern, efficient and customer friendly Tax Administration for Sint Maarten. Assisted by Dutch funding in the country packages, the Tax Administration began the transformation process by targeting elimination of all backlogs. For this purpose, a project team was formed to also begin work on cleansing of the database of the Tax Administration. The team identified and processed unregistered businesses and reached an important milestone on May 17th, 2023, when it published a public tender to replace the department’s outdated IT-system with a modern portal and new IT infrastructure.

Next steps to be taken including:

Essential elements of change management within the Tax Administration:

- Optimize the organization structure and make mandates.

- Adjust function book.

- Improve workflow management and streamline operations.

- Analyse and determine housing needs.

- Claim timely structural budget.

Build the Workforce and Workplace of the Future:

- Support employees, both in terms of the tools they use, the workspace they require and the training they need to match business needs.

- Effective talent management and knowledge transfer.

- Modernize leadership styles.

- Effective training and recruitment.

The planned timeframe for the completion of the modernization program is for the most part, 2025. A transformation team led by a programmanager is driving the transformation process.